Earn Cashback Rewards!

A free spend account for members ages 10-23* who want to avoid fees and earn rewards for using their debit card. Earn Cashback Rewards by simply making a minimum of ten (10) purchases using your Debit Card each month and earn $0.10 for every transaction!*

Account Perks

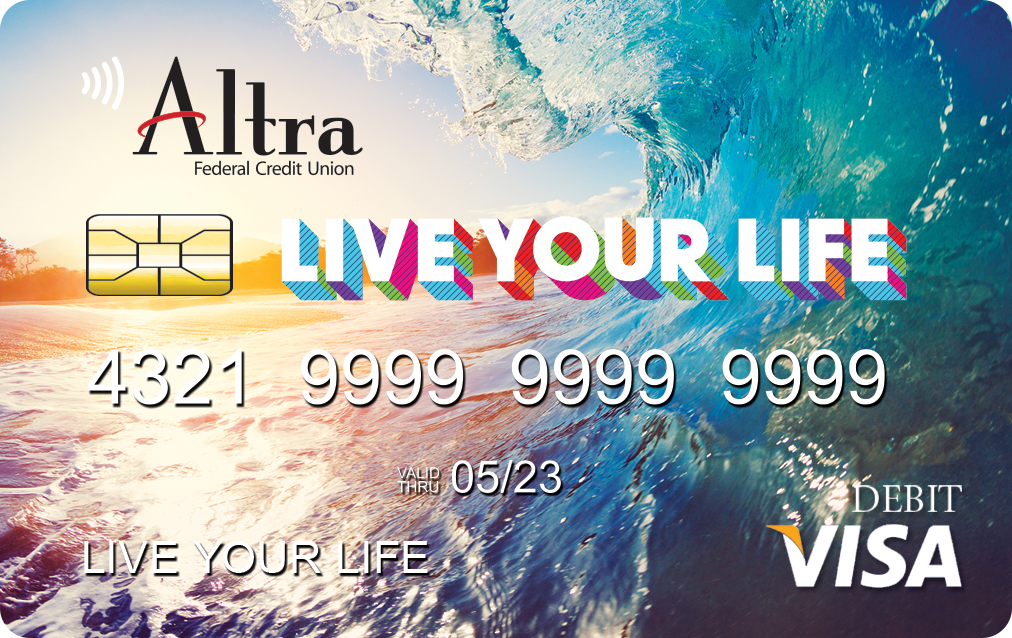

- Free Altra Visa Debit Card

- Free Altra Secure ID Identity Theft protection

- 30,000+ Surcharge-Free ATMs Nationwide

- Free Online Banking

- Free Mobile app with Free Remote Check Deposit

- Free Altra Pay (instantly send money to friends and family)

- Free unlimited ATM withdrawals at Altra-owned ATMs

- Three Free ATM withdrawals/month at non-Altra ATMs, then $1.50 per transaction (surcharges may apply from ATM owner)

Parent Perks

Teaching the value of money and the importance of financial responsibility is a vital lesson for future success. Our Live Your Life Spend Account is a safe and educational first step towards financial independence. This account helps teach safe spending habits and helps your child learn to manage money with a debit card.

For parents joint on their child’s Live Your Life Spend Account, you can:

- Add money to your child’s account from your Altra account through online banking

- Monitor your child’s spending habits through your online banking

- Set notifications for transactions, allowing you to help guide your child’s financial journey

- View monthly e-statements

*Live Your Life Spend Account provides free paper statements to youth ages 17 and under. Ages 13 and up may receive free electronic statements (eStatements) with online banking access. Ages 18 and up may receive paper statements with a monthly service charge. Contact Altra for complete details.

** Online banking is available to ages 13+.

APY = Annual Percentage Yield. Qualifying accounts will earn 0.0% APY. Account available for Altra members ages 10-23 only. Receive Cashback Rewards when you complete a minimum of ten (10) qualified Debit Card purchases ($1.00 minimum purchase per transaction required) per cycle. Check writing is not allowed. Checks presented against the account may be returned unpaid. Debit Card limit may be lowered to $500 upon request. If a new card is issued, a new card limit request is required (if applicable). It may be advisable to keep a smaller balance in the account while the account holder becomes accustomed to using their debit card and monitoring their account balance. eStatements and online banking are encouraged but not required for members over the age of 13 with a valid email address. Members under the age of 13 may receive a paper statement at no charge and should not be provided online banking access. Parents are encouraged to monitor the account under their own personal online banking login. Qualified accounts will receive Cashback Rewards of $0.10 per transaction after the 10-transaction minimum requirement is completed each cycle. Cashback Rewards will be deposited into the account on the 1st calendar day of the following qualification cycle. If account requirement is not completed and/or posted in any given cycle, the account will not receive Cashback Rewards for that cycle. Qualification cycle means the full calendar month beginning on the 1st and up to the last calendar day at 2 pm CST. For tax reporting purposes, Cashback Rewards may be reported as dividends. Membership eligibility required. One account per member; personal accounts only. Not available to Guardianship, Rep Payee, or UTMA accounts. Joint account holder age 18 or over is required if under age 16. Account will automatically transition to an A+ Checking account at age 24. Contact Altra or visit www.altra.org for complete details. Debit card transactions processed by merchants and received by Altra as ATM transactions do not count towards qualifying debit card transactions. Only debit card transactions processed by merchants and received by Altra as Point of Sale (POS) transactions count towards qualifying debit card transactions.

Open a New Account Today