You found your dream car! Find the best way to pay for it: Lease vs Finance.

Understanding the difference between leasing and financing a car will help you determine which option is a better fit for your lifestyle. Lease vs. finance: Drive Altra can help you make the right choice!.

Leasing is like renting a car for a fixed term. You make monthly payments and at the end of the term, you return the car and start the process over again with a new car or agree to purchase the vehicle.

Financing a car means buying it with the help of an auto loan. You make monthly payments and once the loan is paid back you own the car.

Process

|

Both leasing and financing a vehicle start with determining your budget, or what you can afford. Once you have your budget in mind, choose the vehicle and/or dealership you would like to work with. |

Leasing a vehicle starts with finding a brand new vehicle that fits your needs at the dealership you’ve chosen to work with. Next, you will be presented with potential leasing options, which typically include mileage limits, term (or length of lease), payments, and additional fees, charges or down payments that are required. You will be required to submit and receive approval on a credit application with the dealership. At this point, a lease agreement will be presented and must be signed.

Financing a vehicle requires you to apply and be approved for an auto loan through your financial institution or the dealership. You can start with visiting the dealership you’ve chosen to work with and shop for vehicles, new and used or you can start by getting pre-approved through your financial (like Altra)!

Whether you are leasing or financing, you may be required to pay a down payment on the vehicle. The vehicle must also be fully insured, so contacting your insurance provider right away and notifying them of your lease or finance purchase is important. Most leasing companies or financial Institutions will require proof of insurance within a certain period of time after getting your vehicle.

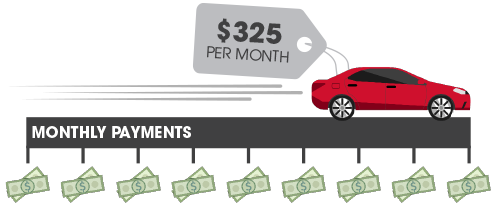

Payments

Leasing generally offers lower monthly payments than finance payments. When you lease, you’re not paying for the entire vehicle, but rather the value you use up for the time you’re driving it. The decline in your vehicles value is known as depreciation. Depreciation is what you are paying for when you lease a vehicle.

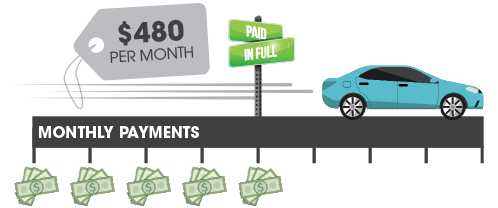

Financing a vehicle means monthly payments go toward repaying the lender. Your payment will include the principal and interest. Once you have paid your auto loan in full, the vehicle is yours to keep!

Customization

Leased vehicles may still be allowed to be customized. Any money spent on customization will be lost if the vehicle is turned in at the end of the lease.

Financed vehicles can be customized any way you like and at any time. Any customizations done to the vehicle may be considered an increase to the value when trading in or reselling.

Mileage

Leasing offers a variety of mileage options to choose from to meet your driving needs. However, if you exceed your mileage limit, you are responsible for any mile overage charges, unless you choose to purchase the vehicle when the lease period is over.

Financing allows you freedom to drive as many miles as you want, just keep in mind that higher mileage will lower the vehicle’s trade-in or resale value.

Wear & Tear

Leasing offers a variety of mileage options to choose from to meet your driving needs. However, if you exceed your mileage limit, you are responsible for any mile overage charges, unless you choose to purchase the vehicle when the lease period is over.

Financing allows you freedom to drive as many miles as you want, just keep in mind that higher mileage will lower the vehicle’s trade-in or resale value.

End of Term

Leased vehicles approaching the end of their lease term, will receive a notification from the financial that owns the lease and the dealership. You will have the option to purchase the vehicle, return it, or lease a new one. If you choose to return your leased vehicle, a vehicle inspection will be scheduled to determine if there are any additional charges that need to be paid.

Financed vehicles are owned, which means you assume responsibility for major repairs, whereas leased cars are typically covered by a warranty. Once a financed vehicle is paid in full you will own the vehicle and be given the vehicle title. When you sell the vehicle, any profits are yours.

Lease then Finance

Lease then Finance

Once your leasing term is over, you may have the option to finance the remaining portion of the vehicle’s residual value. You’ll want to evaluate the pros and cons of lease vs finance again at that time, as well as your budget.

Lease vs Finance Pros & Cons

Lease

Pros

- Typically, a lower monthly payment than financing

- Drive a new vehicle every term

- Warranty protection for repairs throughout term

Cons

- Limited mileage

- You do not own the vehicle

- Can incur additional charges for mile overage or wear and tear

Finance

Pros

- No mileage limits

- Freedom of ownership and customization

- Ability to be payment free once paid in full

Cons

- Typically, higher monthly payments than leasing

- Financially responsible for maintenance and repairs

- Depreciates over time with unpredictable resale value

What is the difference between leasing and buying a vehicle? Leasing is like renting a car for a fixed term. You make monthly payments and at the end of the term you return the car and start the process over again with a new car. Financing a car means buying it with the help of an auto loan. You make monthly payments and once the loan is paid back you own the car. When buying a vehicle, your monthly payments go towards repaying your lender, plus interest. Unlike leasing, where your leaser owns the vehicle and you continue to pay monthly for the length of the lease. In general, leasing payments are lower than finance payments. When you lease, you’re not paying for the entire vehicle but rather the value you use up for the time you’re driving it. In the short term, based solely on monthly payments, it’s typically cheaper to lease than to finance. The advantage of financing a vehicle is once you’ve paid back your auto loan you own it and no longer have to make monthly payments. Plus, you get the benefit of any residual value if you decide to sell or trade in your car in the future. There are other factors that can influence the value over time. When you own a vehicle, you assume responsibility for major repairs whereas leased cars are typically covered by a warranty but leasing can come with all sorts of surcharges– like mileage overages and excessive wear and tear fees. It’s ultimately up to you whether to lease or buy. Some people prefer to drive a new vehicle every few years even if that means limiting their mileage. Others prefer the freedom of ownership and being able to drive as much as they’d like and customize their vehicle however they want. To determine if leasing or buying is right for you, do your research. DriveAltra can help!

Drive Altra is here to help you become an expert when it comes to making a vehicle purchase. When you’re ready, explore Drive Altra for competitive rates, loan calculators, and even a vehicle search tool. Our team in the Lending Center is ready when you are to help you live your best life.