Important Information

Due to the recent Senate Bill (SB 1311) and Assembly Bill (AB 1311) changes for GAP in California, Altra is not allowing GAP to be sold on loans for MLA covered members who live in California.

Rev Up Program

- Maximum days to 1st payment is 60 days

- Income verification must match income amount in application or loan may not qualify for approval

- Loans approved under the Rev Up Program will qualify under different rates than Altra’s standard rates and these loans will not qualify for Altra’s rate discounts

- Back ends can be sold on these loans but loan terms cannot be extended for back ends (please contact an Altra Dealer Account Rep if questions on max term allowed on a specific deal)

All Lien Filings should be displaying our lienholder address as:

Altra Federal Credit Union

1700 Oak Forest Drive

Onalaska, WI 54650

Address Verification – As part of Altra’s Customer Identification Program (CIP), proof of address is required for all new members. To ensure we have proper address verification for new Altra members, Altra has created a new loan stipulation as a reminder for collecting proof of address.

Loan Stipulation For Address Verification – If a new member to Altra, please submit proof of current address if driver’s license or income verification, does not match address on loan application.

As noted in the loan stipulation, additional proof of address is only needed if the driver’s license or income verification provided in the funding packet does not match the member’s current physical address. In cases where additional proof of address is required, below is a list of acceptable documents for address verification.

- Bank Statement

- Cable Bill (less than 2 months old)

- Certified Copy of School Records/Transcripts

- Credit Report

- Deed/Mortgage Statement

- Drivers License, Permit, or State ID (expired clipped IDs with receipts are acceptable)

- Income Tax Return

- Online Drivers License Renewal Print out (photo printed on form)

- Payroll Check Stub

- Rental or Lease Agreement

- Safe at Home card

- Social Security Statement

- Utility Bill (less than 2 months old)

- Voter Registration Card

Vehicle Valuation – For new vehicle valuations, Altra is able to use the invoice total or cash price minus discounts plus tax, title, license. Please be sure you are using the invoice total and not the MSRP amount when entering the vehicle value for loan review.

Frontend/Backend Products

It is the dealership's responsibility to ensure the borrowers meet all eligibility requirements when selling any frontend or backend products. If products are sold to borrowers not meeting eligibility requirements, the dealership is responsible for refunding any premiums paid by the borrowers.

Meet our Indirect Lending Staff

Dealer Account Representatives

Hours

Monday, Wednesday, & Thursday: 8:00am – 8:00pm

Tuesday & Friday: 8:00am – 6:00pm

Saturday: 8:00am – 4:00pm

Processing

Processing Hours

Monday & Friday: 8:00am – 5:30pm

General Line

608-787-7530

Payoff Line

Payoff Line

800-755-0055

Monday – Friday

7:30am –5:30pm CST

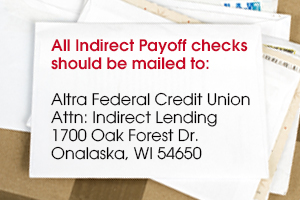

Mail / Delivery

Altra Federal Credit Union

Attn: Indirect Lending

1700 Oak Forest Drive

Onalaska, WI 54650

Fax

608-779-3179