Compound Interest: Slow and Steady Wins the Race

Compound interest means earning interest on your interest. It’s essentially free money!

Two awesome words: Compound Interest. It may sound intimidating, but it really isn’t once you know what it means. It simply means that when you invest your money, not only will you earn money on what you have saved, but you also earn money on the interest you received on that money (assuming you leave it alone).

Check out this story of Brad and Jenny to understand the power of compound interest.

Meet Brad.

Brad started saving at age 18 and decided to invest $2,000 every year for sixteen years.

At age 34, Brad stopped putting money into his investments. He put a total of $32,000 into his investment funds. From there, he decided to let the money sit and not add or take any from it.

Meet Jenny.

Jenny started saving at age 34. Just like Brad, she put $2,000 into her investment funds every year until she turned 65.

Jenny invested a total of $64,000 over 31 years.

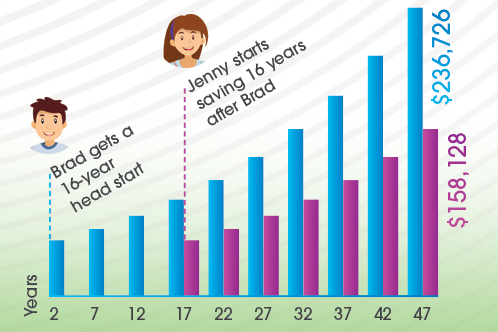

Both Brad and Jenny earned a 5% investment rate.

Who do you think had more?

Brad, with his total of $32,000 invested over 16 years, or Jenny, who invested $64,000 over 32 years?

Believe it or not, Brad came out ahead … $78,000 ahead! Jenny had a total of $158,128, while Brad had a total of $236,726.

How did he do it? Starting early is the key. He put in less money but started sixteen years earlier. That’s the power of compound interest! It turned Brad’s $32,000 into over $236,000! Because Brad invested earlier, the interest kicked in sooner.

It Pays to Save!

The trick is to start as early as possible. The younger you are, the more time you have on your side.

What is compound interest? Compound interest means earning interest on your interest. It’s essentially free money. Let’s take a look at the power of compound interest. Meet Brad. Brad started saving money when he was 18 years old. He saved $2,000 a year for 16 years and then stopped. This means Brad put a total of $32,000 of his own money into his investment account. From there, he decided to let the money sit and not add any more to it. Now let’s meet Jenny. Jenny didn’t start saving money until age 34. She also saved $2,000 a year. However, unlike Brad, she continued to save every year through age 65. For a total contribution of $64,000 of her own money into her investment account. During this time both Brad and Jenny earned a 5% annual return. Now lets fast forward to age 65. Whose investment do you think is worth more? Brad, with his total of $32,000 invested over 16 years, or Jenny, who invested $64,000 over 32 years? Over time, compound interest accelerates your savings. Believe it or not, Brad came out ahead… over $78,000 ahead. Starting early is key! Brad put less money in but started 16 years earlier. Since he invested earlier, the interest kicked in sooner. It turned his $32,000 into over $236,000 and he didn’t have to do a thing! Saving a little now means earning a lot more interest later. Start saving today!