Loans and Borrowing

Are you thinking about buying a “big ticket” item like a vehicle, borrowing money for school, or purchasing a home? If so, you might be looking at a loan to help pay for these items..

What is a loan?

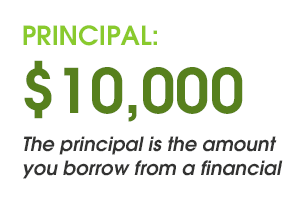

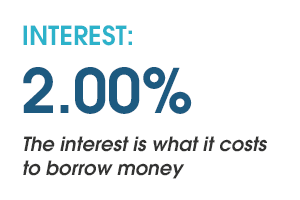

A loan is a sum of money borrowed from a financial with an agreement to pay back the amount borrowed, plus interest.

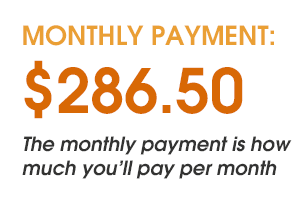

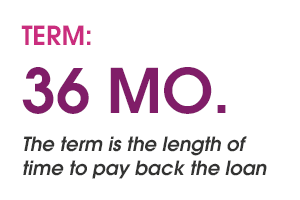

While there are many different types of loans, most loans can be broken down into 4 parts:

Now that we understand the basics of a loan, follow these steps:

First: Determine Your Need for the Loan

When determining why you need a loan, it’s important that your purchase will help improve your finances. For example, a reliable vehicle can help you get to work so you can earn money, a student loan can increase your earning potential, or a home loan can get you a property that’ll hopefully grow in value.

Next: Determine How Much You Can Afford

Keep a realistic monthly budget.

Tip: If you are unsure if you can afford payments on a loan, put whatever the monthly payment would be in a savings account every month. If you are able to pay bills and everyday expenses without using that money, then you can consider taking out the loan.

And now that you have that savings built up, you can use that money as a down payment. A down payment can decrease your monthly payment and interest paid, and increase your chances of being approved for the loan.

If you don’t have a budget created, we recommend creating one to help determine how much you should spend and save each month. Review our Budgeting Basics to get started.

Finally: What to Expect During the Loan Process

When looking for a loan, you will work with a lender. Lenders guide you through the loan process and will need to know your income, employment history, and will check your credit history. If you’ve had trouble with credit in the past, or haven’t had experience with credit, it could be more of a challenge to get a loan. In this situation, a co-signer might be needed. A co-signer is someone who has good credit and is willing to be responsible for making payments if you are unable to.

Taking out a loan is a big responsibility, but by familiarizing yourself with these steps, you can feel confident and prepared when searching for a loan for your big-ticket item.

Are you thinking about buying a “big ticket” item like a vehicle, borrowing money for school, or purchasing a home? If so, you might be looking at a loan to help pay for these items. A loan is a sum of money that is borrowed from a financial with an agreement to pay back the amount borrowed, plus interest. While there are many different types of loans, most loans can be broken down into 4 parts: The principal is the amount you borrow, The interest is what it costs to borrow money, The monthly payment is how much you’ll pay per month, And the term is the length of time to pay back the loan. Now that we understand what a loan is and the 4 main parts, let’s determine our need for the loan, understand how much we can afford, and what to expect during the loan process. When determining why you need a loan, it’s important that your purchase will help improve your finances. For example, a reliable vehicle can help you get to work so you can earn money, a student loan can increase your earning potential, or a home loan can get you a property that’ll hopefully grow in value. Next, you’ll need to know how much you can afford. Be realistic on what works within your monthly budget and understand what the total cost will be when you finish paying back the loan. The total cost of the loan is the principal + interest + any additional fees. The term of the loan will affect the amount of interest paid — so the longer you stretch out the loan, the more interest you’ll pay over the term, costing you more money. If you’re unsure if you can afford payments on a loan, put whatever the monthly payment would be in a savings account every month. If you’re able to pay bills and everyday expenses without using that money, then you can consider taking out the loan. And now that you have that savings built up, you can use that money as a down payment. A down payment can decrease your monthly payment and interest paid, and increase your chances of being approved for the loan. Finally, when you’re looking for a loan, you’ll work with a lender. Lenders will guide you through the loan process and will need to know your income, employment history, and check your credit history. If you’ve had trouble with credit in the past, or haven’t had experience with credit, it could be more of a challenge to get a loan. In this situation a co-signer might be needed. A co-signer is someone who has good credit and is willing to be responsible for making payments if you are unable to. Always shop around and compare offers to get the best rate possible. Make sure to read through your loan agreement and ask questions if something isn’t clear. Taking out a loan is a big responsibility, but by answering the questions and familiarizing yourself with these steps, you can feel confident and prepared when searching for a loan for your big-ticket item.

Altra is here for you when you need a loan. We’re not just here to provide loans, but to provide you with education on the entire loan process. We offer competitive rates and unique loan types to help first time borrowers. Our loan experts will work to get you the best loan for your needs while taking the time to educate you on the loan process. You’ll walk away with your loan and confidence!

Got questions? We’ve got answers. Give any of our consumer loan or mortgage loan experts a call, email, or even video chat with us with any questions.