Realistic strategies to get out of debt!

Getting into debt can be easy…getting out of it, not so much Following these steps can make becoming debt-free a reality!

First: Start by making a list of all debts

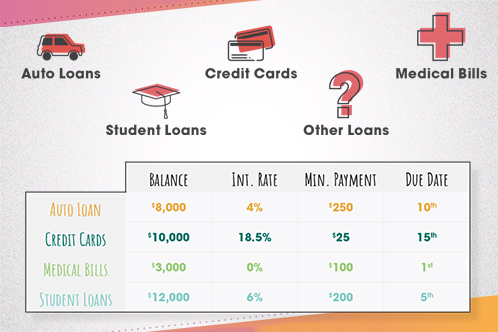

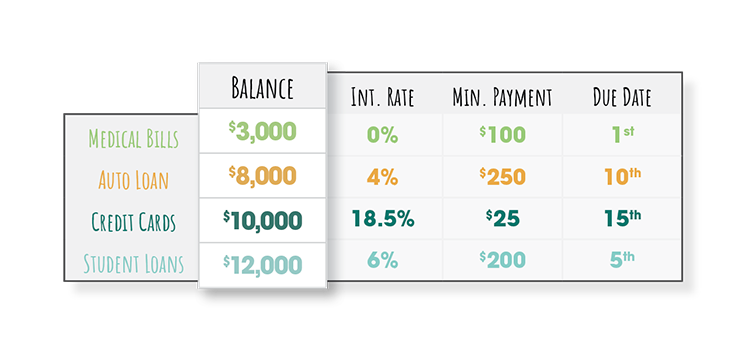

Include debts like auto and student loans, credit cards, medical bills, or any other loans. While you’re making that list, write down the balance, interest rate, minimum payment, and due date for each.

Next: Chose a debt repayment strategy

1.Arrange your debts by balance from smallest to largest.

2. After making the monthly minimum payment on each, put the rest towards paying off the debt with the smallest balance.

3. Once that debt is paid in full, apply that payment to the next smallest debt.

With this method, small debts are quickly crossed off your list, giving you the confidence and motivation to keep going.

1.Arrange your debts by interest rates from highest to lowest.

2. After making the monthly minimum payment on each, put the rest towards paying off the debt with the highest interest rate.

3. Sometimes that debt may have a large balance, so it might not feel like you are making as much progress.

However, with this method, you get rid of your most expensive debt first and in the long run, save money on interest.

Ultimately, it’s up to you to choose what debt repayment strategy is best for your lifestyle. It’s important to not add any additional debt to what you already have. Debt repayment requires action, discipline and a lot of patience – but the efforts you make to eliminate your debt will be worth it in the end!

Debt is stressful and expensive, and it limits the amount of money that you can put towards other things.

If you’re ready to get serious about tackling your debt, start by making a list of all of your debts, including auto loans, credit cards, medical bills, and student loans. Write down the balance, interest rate, minimum payment, and due date for each debt.

Next, choose a debt repayment strategy: The Snowball Method or the Avalanche Method.

First up: The Snowball Method. With this method, you arrange your debts from smallest balance to largest balance. Every month set aside as much money as possible for debt repayment. After making the minimum payment on all your debt, put the rest towards paying off the debt with the smallest balance. Once that debt is paid in full, you’ll apply that payment to the next smallest debt. With this method, you’re starting off small but as you begin to pay off debts, your payments grow. Like a snowball getting larger and larger. Small debts are quickly crossed off your list, giving you the confidence and motivation to keep going.

Next: The Avalanche Method. With this method, you arrange your debts by interest rates from highest to lowest. Every month you make the minimum payment on each and the rest of the money you set aside for debt repayment goes toward the loan with the highest interest rate. By doing this, you get rid of your most expensive debt first and in the long run, save money on interest. Sometimes that debt may have a large balance, so it might not feel like you’re making as much progress as in the Snowball Method.

It’s up to you to choose which method will work best for you. If you’re unsure, talk to Altra about debt counseling or other resources that might be available to you.

Another key element in paying down debt is not adding more debt to what you already have. Eliminate credit card spending and rely on cash or your checking account for expenses. You may need to increase your income through extra work or another job to make your plan work.

Getting into debt can be easy…getting out of it, not so much. Debt repayment requires action, discipline, and a lot of patience. In the end, the efforts you make to eliminate your debt will all be worth it!