Locked out and need your password reset?

Lockouts in online or mobile banking typically occur after three unsuccessful login attempts. If you are locked out of your online account, click the “password reset” option on the login page to initiate the process of resetting/changing your password to unlock your account and regain access.

If you weren't the one attempting to log in when this happened, then you will also want to update your Username, as a bad actor may be attempting to log in as you. You can do this by navigating to the Member Profile tab on your web browser and changing your User ID. Use a unique username with different numbers and letters. It is important to use uncommon and unpredictable usernames and passwords for your financial accounts. The great news is that, while inconvenient, the security measures in place protected your account.

Cybersecurity Tip: Look out for Spoofed Websites!

Stay on the lookout! All companies can be impersonated, even financial institutions. Fraudsters will often create fake websites and pay to promote them as ads so that they will move to the top of your search results. Altra constantly monitors for brand impersonations to take down fake sites. However, new sites may pop up at any point in time. Here are some tips that you can use to protect yourself, your accounts, and your information from falling victim to phishing attempts:

- Direct Navigation: Skip Google or Bing searches; enter known web addresses in your browser’s address bar. Altra’s authorized domains are altra.org and altraonline.org. If you see our website with a different domain, don’t trust it. Altra’s link is verified in Bing and will display the Altra Logo in Google.

- Trust Your Gut: If something does not seem right, back out of the webpage and report it to Altra.

- Take Action: If you have given out any of your confidential information such as account info, login credentials, etc. on a suspicious site, email, text or call, contact Altra right away and change your login credentials.

- Boost Your Protection: Take advantage of extra security layers such as signing up for Altra’s Online Banking Alerts and registering for Multi-factor Authentication/One Time Passcodes.

- Double Check: If you enter your credentials on a page you believed to be Altra’s Online Banking Login Page and it loops you back without an error, review your browser history to verify the web address’s legitimacy. If it is not a legit address, please contact us to report the issue.

Your security is our top priority, and by staying vigilant, we can ward off potential threats and keep your financial well-being secure. Contact us at 800-755-0055 to report any suspicious activity or to help verify an Altra site.

Visa Purchase Alerts

Get a text or email whenever you pay with your Visa card.

Alerts from Altra powered by Visa® help you reduce fraud and monitor your spending anytime, anywhere. With near real-time alerts, you can receive updates on your Visa® card activity through text messages and email. And this service is available free for Altra Visa® cardholders.*

Altra Secure ID: Free Identity Theft Protection powered by CyberScout™

If you have an Altra checking account or credit card, you and your family* have access to Altra Secure ID, a free identity theft protection powered by CyberScout™.

If you’ve become a victim of identity theft or discover that you’ve lost your wallet, call Altra at 800-755-0055 and we’ll connect you to an advocate who can answer questions and help you through ID Theft resolution.

Altra will never contact you directly to verify any account information over the phone or through email.

If you have any questions or concerns, please call us at 800-755-0055. If you receive an email purportedly from Altra that you feel is suspicious, please FORWARD that email to info@altra.org to verify its authenticity.

Scams on the Rise - Protect Your Finances Now

How to Recognize Fraud

- Phishing Emails: Be cautious of unsolicited emails asking for personal or financial information. Think before you click—never click on suspicious links or download attachments from unknown sources.

- Suspicious Calls: Be wary of unexpected calls urging you to share personal or financial information. Don't call a number they gave you or the number from your caller ID. Instead, contact them using a website you know is trustworthy.

- Unusual Transactions: Regularly review your accounts and notify us of any unfamiliar or unauthorized transactions immediately.

- Fake Websites: Verify the legitimacy of websites before entering personal or financial information. Look for HTTPS and check for misspellings or inconsistencies.

- Social Engineering: Fraudsters may impersonate people you know. Confirm requests for money or information through a separate means of communication. Anyone who pressures you for money or personal information is a scammer.

Be Proactive

- Secure Usernames & Passwords: Create strong, unique usernames and passwords for your accounts. Use a combination of uppercase and lowercase letters, numbers, and symbols. Do not include personal information that is easily accessible or guessable, such as your name or birthdate. A good password should be at least 12 characters long. Don't use the same username and password across multiple platforms. If one account gets compromised, it could put other accounts at risk.

- Multi-Factor Authentication: Enable multi-factor authentication wherever possible to add an extra layer of security to your accounts.

- Update Software: Keep your devices and software up to date with the latest security patches.

- Educate Yourself: Stay informed about common scams and fraud schemes.

What We Will NEVER Ask For

Altra will NEVER contact you unexpectedly and ask you to provide any of the following:

- Personal Identifying Information: Social Security number, date of birth, contact info, or any other sensitive personal data.

- Financial Information: Account or card numbers.

- Online Account Information: PIN, usernames, passwords, answers to challenge questions, codes, shadow requests, or any other info that allows access to your accounts.

- Request to Send Money: Cash, gift cards, Bitcoin, money transfers, crypto, wire, or money orders.

- Request to Shadow Your Computer/Device: We will never ask to access your computer or device remotely.

Take Action

Log in to Online Banking today and strengthen your online and mobile banking password!

- Change Password: Select Change Password from the Security & Alerts drop-down menu.

- Change Username: Select Change User ID from the Member Profile drop-down menu.

Travel Notice

Don’t be stranded!

Going across the country or around the world? Before you leave home, click on “Travel Notification” on the Online Services menu in Online Banking to submit travel plans to be added to your Altra Credit and/or Debit Card. This minimizes the chance of cards being declined. Enter the last 4 digits of your cards, travel dates and destinations, and the best way to contact you.

You can also call Altra’s Member Contact Center at 800-755-0055 or visit your local branch to speak to a member service specialist so we can add a note on your account. Whichever method you choose, please allow one business day to have your cards updated with your plans.

Beware: Tax Scam Calls

People across the US are getting phone calls or emails from scam artists who pretend to be from the IRS or Department of the Treasury. They demand immediate payment of overdue taxes and threaten lawsuits or jail. They look and sound convincing, but they are trying to steal your money and your identity.

The IRS does NOT make initial contact with taxpayers by phone or email. Click the link below for tips from the IRS to help you avoid being a victim of a tax scam:

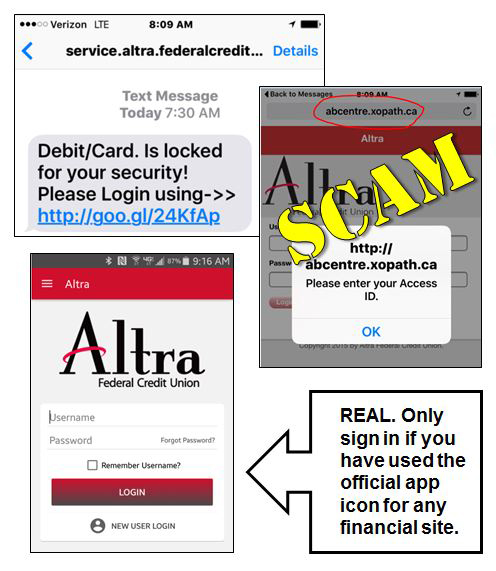

Scam Text Message: Debit Card Blocked

Members and non-members who have mobile numbers with a 608 area code are receiving scam text messages saying their Debit card is blocked. There is a link in the text to sign in to unlock, which takes them to a fake Altra mobile banking site.

If you receive one of these texts, DO NOT CLICK the link or enter any personal information. Never access any mobile financial site unless you are using the official app icon from the app you downloaded from iTunes or the Google Play Store.