Annual Tax Forms now available for eStatement users.

If you receive Altra E-statements within Online Banking, you will not receive paper tax forms in the mail. E-statement users will receive a secure email notice from Altra when your tax, mortgage interest, and property tax statements are available to view or print within Online Banking. E-statement users receive this notice up to 10 days earlier than non-E-statement users.

How to access your tax forms in Online Banking:

- Log in to Altra Online Banking

- Click the “Online Services” Tab and select “eStatements”

3. Choose “Account Notices” for Property Tax letters:

4. Choose “Tax Forms” for 1098 Tax Forms & 1099-INT:

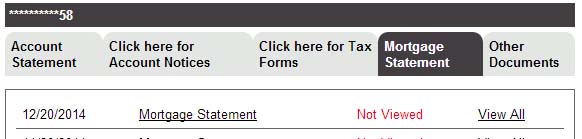

5. Choose “Mortgage Statements” for Mortgage Statements:

Important Tax Form Information

- Dividends paid to a single tax ID / SSN totaling less than $10 are not reported to the IRS

- One 1099 INT Form is issued per Tax ID / SSN combining all dividends earned for all Altra account suffixes

- If you earned less than $10/year, you will not receive a 1098 Tax Form.

- Interest of $600 or greater paid on real estate loans (first mortgage, home equity, home improvement or land) is reported on IRS form 1098. Interest less than $600 is not reported to the IRS

- If you have a mortgage loan, it will be a separate tax statement

- If you refinanced a mortgage loan, you will receive TWO Mortgage interest statements: One for the previous mortgage loan number and one for the newly refinanced mortgage loan.

- If your membership account has been closed, you will no longer have access to Altra Online Banking. Your Tax forms will be mailed to the address on file.

Set up Direct Deposit for your Tax Refund

The IRS will transmit your tax refund directly to your Altra account, and your refund will arrive up to three weeks earlier than if received by mail. There is no check to get lost or stolen, and your refund is instantly deposited.

Track your Federal Tax Refund

Track your Federal Tax Refund through the official IRS.gov website at https://sa.www4.irs.gov/irfof/lang/en/irfofgetstatus.jsp

Electronic Federal Tax Payment System (EFTPS)

EFTPS is a service offered free by the U.S. Department of the Treasury for people to pay federal taxes electronically.