Add New/Additional Account in Online/Mobile Banking

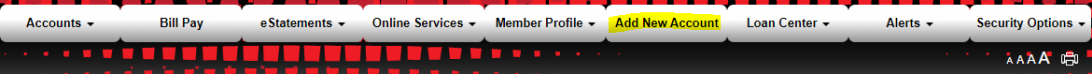

1. Click Add New Account in Online Banking Menu

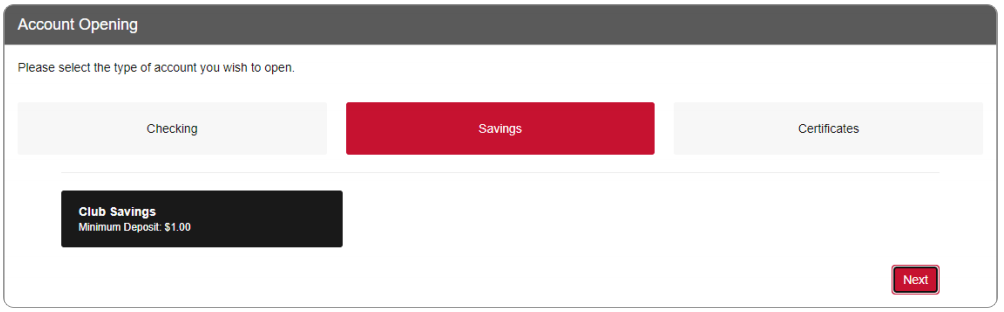

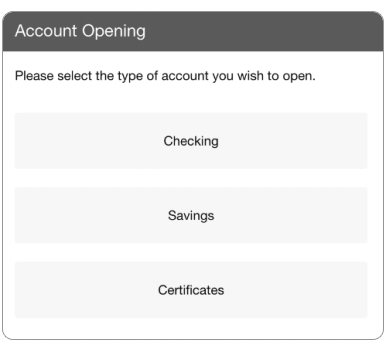

2. Choose the account type.

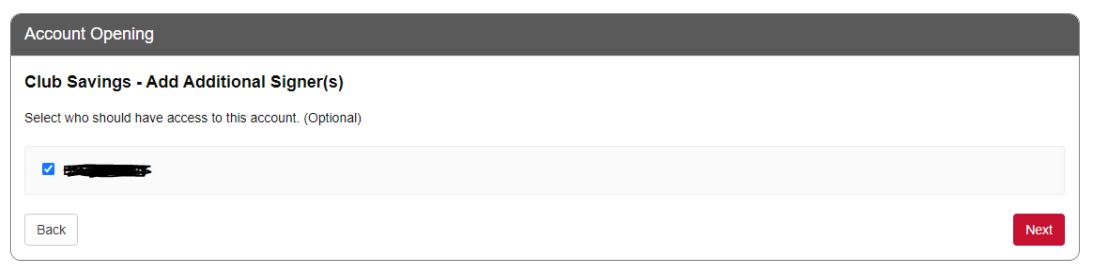

3. Add joint owner(s) (optional for members 18+)

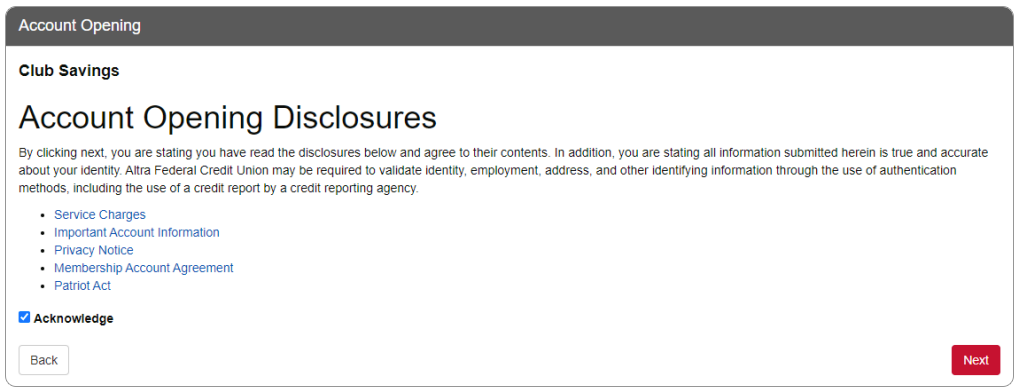

4. Acknowledge the disclosures

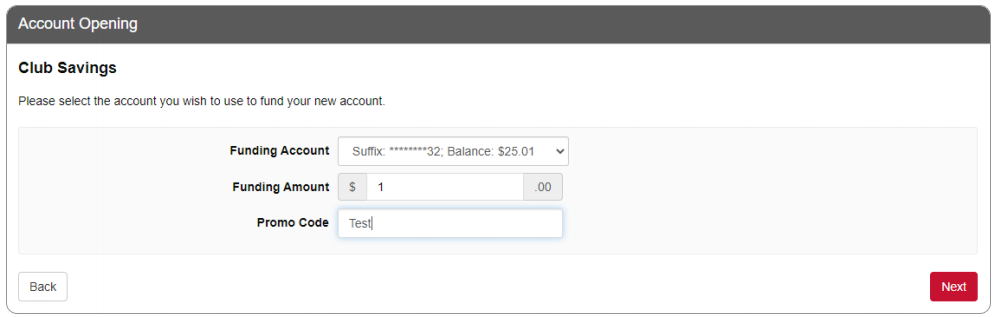

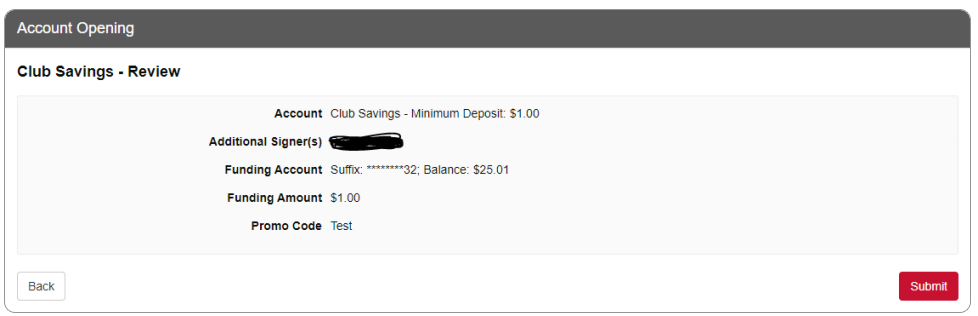

5. Choose the deposit amount and funding account

6. Review and submit

7. Member can return to Account Summary or the Dashboard to see the new account immediately

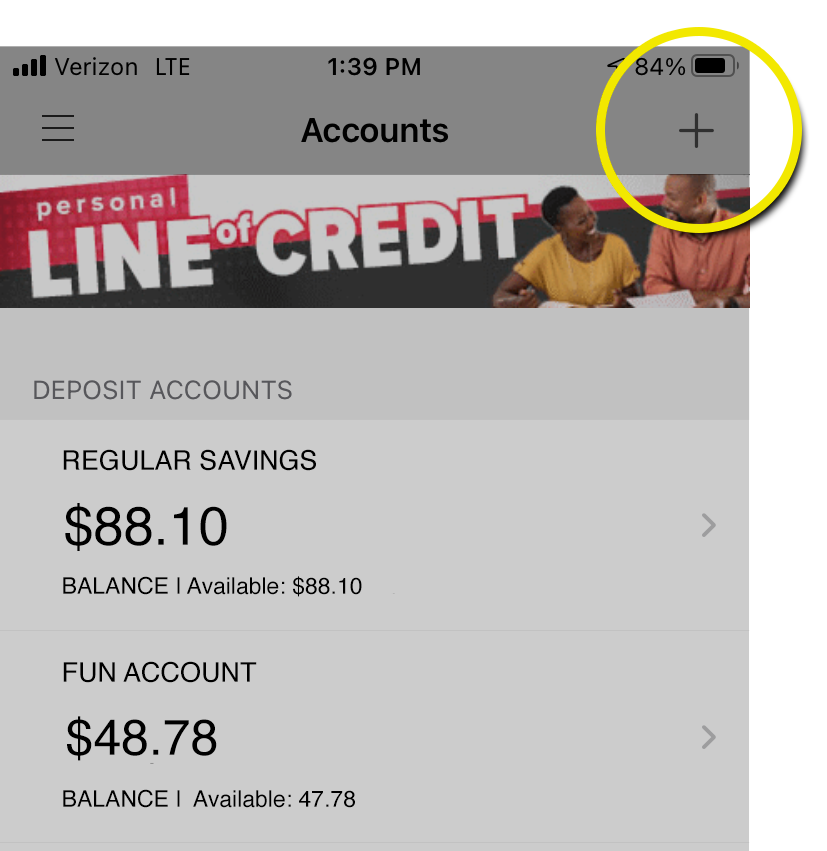

To Add a New Account Via Mobile Banking.

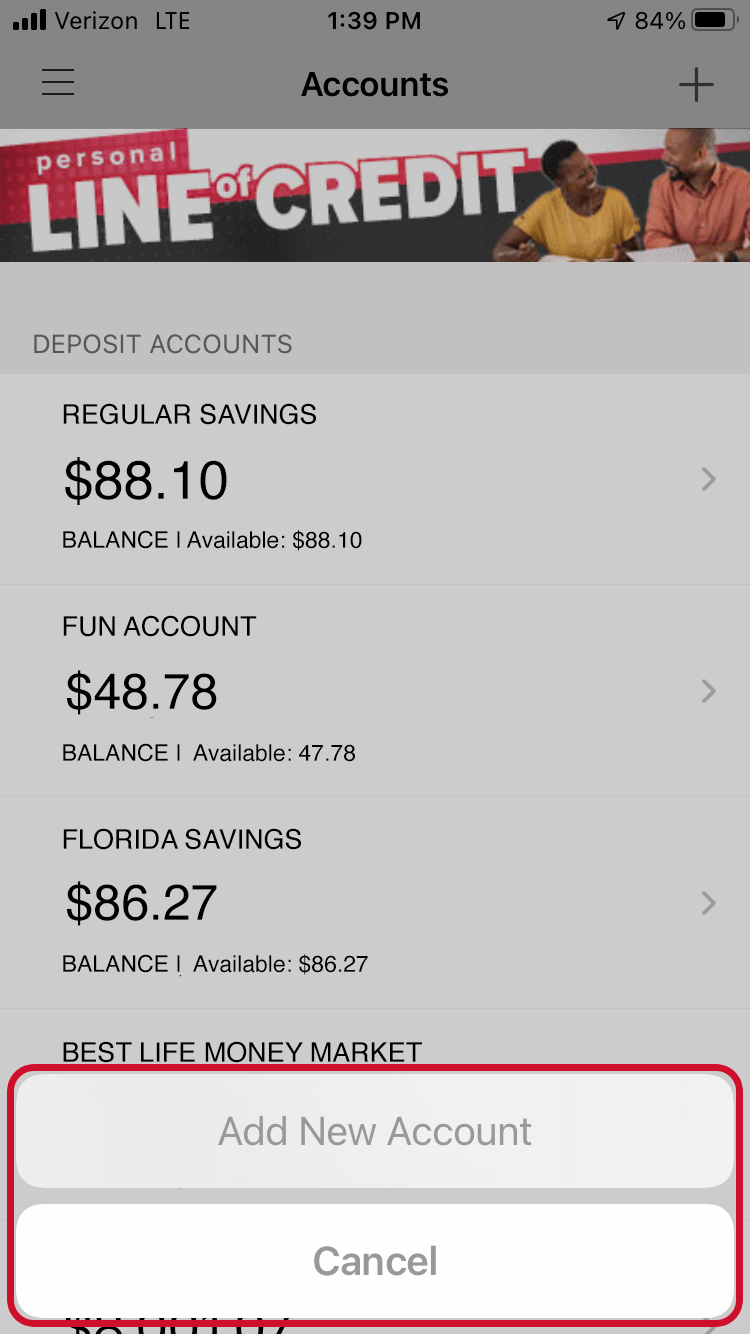

1. Click on the ‘+’ plus sign in the upper right-hand corner of the Accounts screen

2. Click ‘Add New Account’

3. Select the type of account you wish to open

4. Follow the remaining steps from the Online Banking flow listed above

- Add joint owner(s)

- Acknowledge the Disclosures

- Choose funding account for deposit

- Review and submit

- Account is now visible via accounts menu in mobile banking

Deposit Insurance

Your savings at Altra are federally insured to $250,000 with IRA accounts insured separately for an additional $250,000. The National Credit Union Share Insurance Fund (NCUSIF), is a federal fund backed by the full faith and credit of the United States government.