Don’t let someone steal your identity!

Identity theft occurs when someone uses your personal information without your permission. For instance, they could use your name or Social Security Number to fraudulently open credit accounts, use existing credit and banking assets, and even commit crimes!

An estimated 9 million Americans have their identities stolen each year. Follow these tips to help protect yourself!

Be careful who you give your information to.

Only give your information to trusted sources.

Be alert at all times.

Set alerts on accounts, verify monthly statements, and check your credit reports.

Don’t leave important personal information out (even at home).

Often, theft occurs by someone you know. Keep important documents in a safe place and shred old documents.

Check your credit report for fraud.

You are entitled to receive one free report per year from these three bureaus.

Protect passwords and don’t blindly trust technology.

Change your password regularly and keep it a secret!

Be aware of your Wi-Fi connection.

Avoid checking your bank accounts or doing online shopping on public Wi-Fi networks. Public Wi-Fi usually isn’t encrypted, which means the data you send can be monitored.

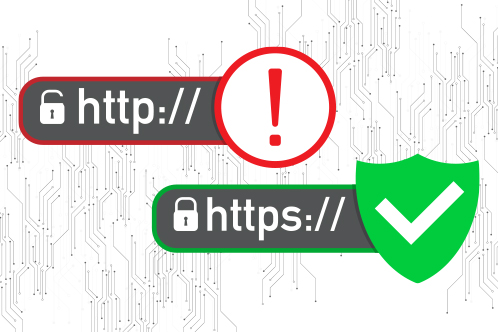

Make sure the website you visit are secure.

Secured websites will show as https:// versus http:// and will typically display a locked padlock symbol.

If you have an Altra checking account or credit card, you have access to Altra Secure ID, a free identity theft protection program powered by CyberScoutTM.